e-Way bill (Electronic way bill) is a document that has to be generated from the GST e-Way bill portal when goods worth more than Rs 50,000 are transported or shipped to the consignee. Even if it's for a meagre one kilometre! It was introduced to track the movement of goods and curb tax evasion. Whether transportation is interstate or intrastate(*), the transporter should have a physical or digital copy of the e-Way bill in hand before the journey commences and till the goods are delivered.

*States have defined their own rules on e-Way bill for intra-state transportation i.e., transportation of goods within the state. For e.g., in Delhi, West Bengal and Tamil Nadu, e-Way bill is to be generated only if the invoice amount is greater than Rs.1 lac.

Any supply of goods or return of goods worth more than Rs. 50,000 has to be transported with an e-Way bill. Retail and distribution business relationships are built on purchasing goods on credit, still an e-Way bill has to be generated even if the payments are not done for the transported goods.

However, if even one party is unregistered, say, the supplier, then it's the responsibility of the retailer or transporter to generate the document.

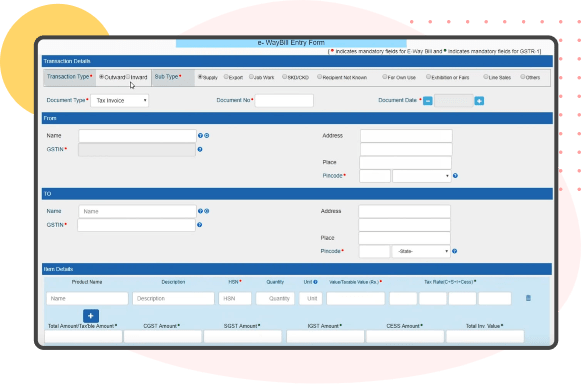

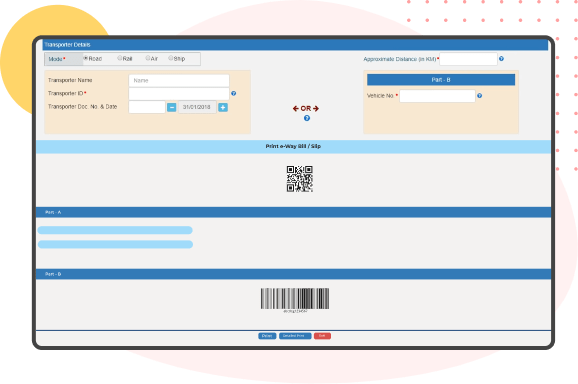

The e-Way bill consists of two parts. In the first part (Part A), invoice and recipient details will be available and in the second part (Part B) transporter information such as departure details, vehicle number will be available.

The e-Way bill can be generated from the GST e-Way bill portal but for that, all these details have to filled line by line manually; or an excel sheet containing the details can be imported into the portal.

If you prefer to generate the e-Way bill automatically, you can jolly well do it – with mrakaf! We will generate it for you while you dispatch the goods.

E-Way bill generation can be generated directly from the E-way bill portal by entering the necessary details.

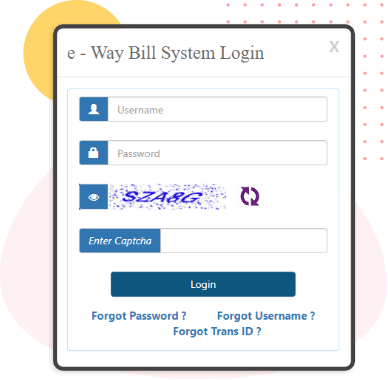

Login to E-way bill portal with the username and password.

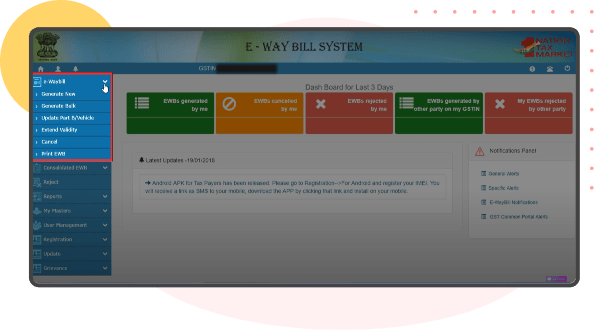

Click on E-way bill in the left side of the dashboard and select "Generate New". E-Way bill can also be bulk generated by preparing the details in bulk and uploading it in ".json" format.

Once you enter the E-Way bill entry form, select transaction type, Document type, sender details, receiver details, item details and transporter details in the part A.

In part B enter the vehicle details along with vehicle number and click submit. E-way bill will be generated along with the QR code and EWB number.

All it takes is a click to upload details to the e-Way bill portal

Step 1 : Register on the e-Way bill portal using your GST number and map the GST Suvidha provider

Step 2 : Connect the Government e-Way billing portal with mrakaf's e-Way billing solution using the username and password generated in Govt. portal

That's it! From now onwards, every sale or sales return invoice made with proper dispatch details in the mrakaf ERP will automatically get uploaded in GST e-Way bill Government portal directly. The e-Way bill will be print ready for the consigner, the consignee and the transporter.

Experience FREE trialFrom 1st January 2021, e-Way bills generated will be valid for one day up to 200 kms. For every extra 200 kms, one day will be added to the validity period. When Over Dimensional Cargo (ODC) or multi-modal goods are transported, the e-Way bills will be valid for one day up to 20 kms only.

An e-Way bill need not be generated,

If the value of goods transported is less than Rs. 50,000

When the mode of transport used is non-motorized

When goods are transported from airport, sea port and land customs station to Inland Container Depot (ICD) or Container Freight Station (CFS)

If the transported goods are exempted from GST tax itself

When goods are transported under Government supervision like Customs, Ministry of Defense

If the distance between the transporter office and the consigner/consignee is less than 10kms and if all the parties belong to the same state

With mrakaf, e-Way in no way would confuse you anyway. One way to the runway is to click on the button below and register. You get a FREE trial of mrakaf ERP and other apps for a full month. And make a lot of headway!

Avail free trialLogin to the e-Way portal and navigate to menu section. Under the "e-Way bill option, choose "update vehicle number" to update the vehicle number. Likewise, even the transporter details can be updated. To change more transport details, under "consolidated EWB" option, choose regenerate

In case of non-delivery, e-Way bill can be cancelled, but only by the party who generated the bill

e-Way bill can be rejected by any party using the "Reject" option in e-Way bill portal

e-Way bills can be extended either eight hours before expiry or within eight hours after expiry by the party who generated the bill only

Status of e-Way bills generated by all parties can be viewed by all the parties in the GST e-Way bill portal under reports section.

Invoice, bill of supply, delivery challan as required

A copy of e-Way bill, e-Way bill number or e-Way bill mapped to a Radio Frequency Identification Device, RFID

1st Oct 2020, e-invoice was introduced under GST. With this implementation, e-Way bills can be auto-populated from the e-invoicing portal itself, provided the transporter id and mode of transport are updated in the e-invoice. This has simplified the e-Way bill process

If one party is unregistered, say, the supplier, then it's the responsibility of the retailer or transporter to generate the document. When the goods are in-transit, the transported should have the e-Way bill in hand

If the transporter is a normal citizen, he/ she can request the supplier to generate an e-Way bill or he/ she can generate by logging into the e-Way bill portal for citizens

The transporter needs to update the details of conveyance in the e-Way Bill on the common portal in Form GST EWB 01 before transferring the goods to another vehicle.